Après la Géorgie (2019), les Etats-Unis (2022), le Mexique (2022), l'Afrique du Sud (2022), la Catalogne (2023), la Serbie (2024), l’Argentine (2024) et le Portugal (2024), l’Uruguay (2025), les partenaires du Vinitech Innovation Tour, en co-construction avec des entreprises du secteur vitivinicole, se dirigent vers de nouvelles destinations. Lancez votre développement international avec nous ! Un programme clé en main en 4 parties : visites techniques, rendez-vous individuels ciblés, conférences techniques et networking

Les Vinitech Innovation Tours continuent

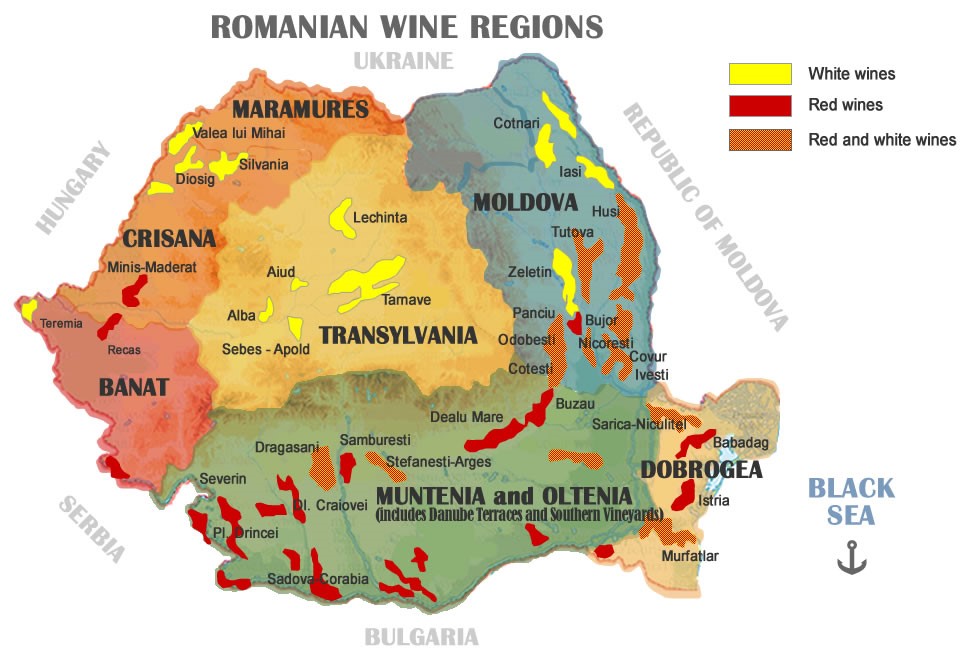

30 juin au 4 juillet 2025 Inscriptions au Vinitech Innovation Tour Roumanie